Basic Examples (3)

Compute the distribution of the amount in excess of 2/3 for a uniform distribution on the interval from 0 to 1:

Compute the mean of the excess:

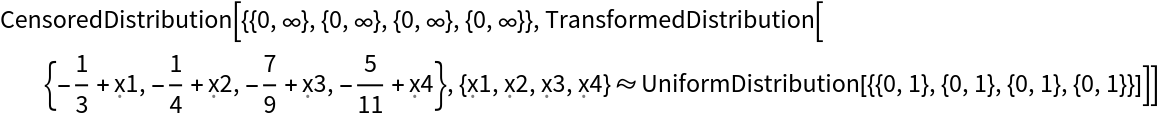

Compute the distribution of the amount in excess of a point for a uniform distribution in four dimensions:

Compute the mean of the excess:

Compute the distribution of the amount in excess of 10 for a log-normal distribution with a mean of 9 and a median of 3:

Compute the mean and standard deviation:

Scope (2)

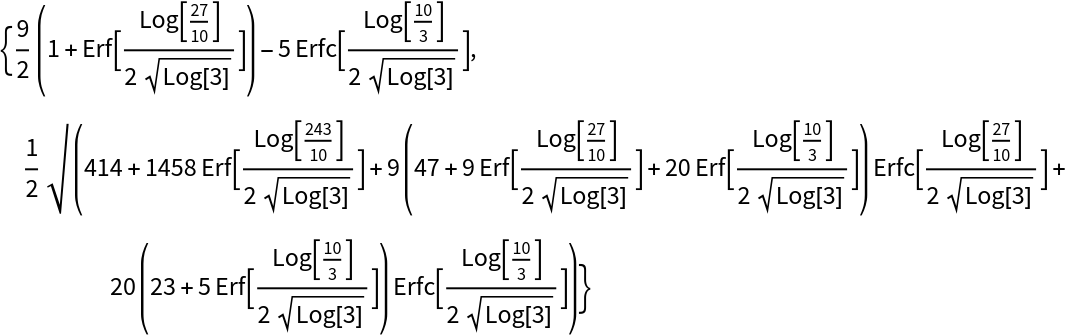

The function works with discrete distributions:

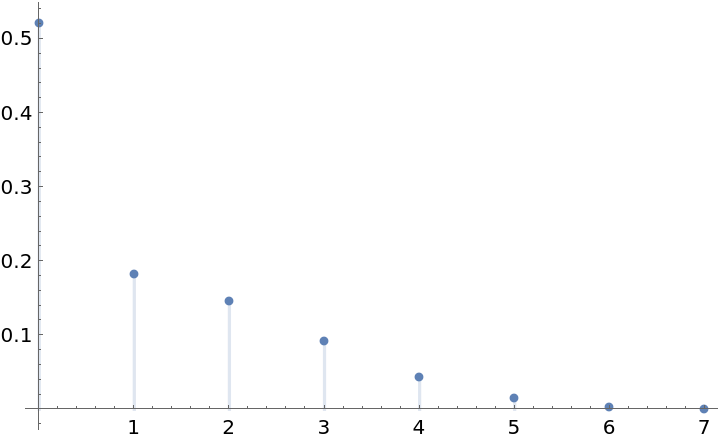

One can compute a symbolic non-negative excess distribution from an underlying symbolic univariate distribution:

Compute various statistics of the resulting distribution:

Calculate for a numeric value:

Properties and Relations (2)

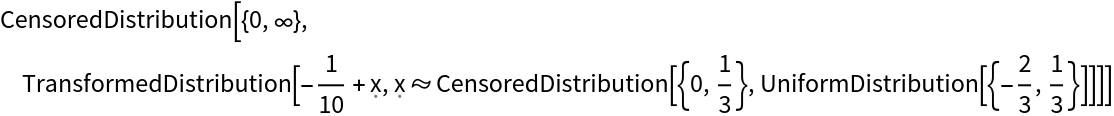

One can nest non-negative excess distributions. Compute the mean amount owed by an insured who has a primary policy that covers up to 2/3 and a secondary policy that will pay any amount remaining (but not exceeding 1/10) after the primary has paid its 2/3:

The result is no different than if there was a primary policy with a limit of 2/3 and 1/10:

Applications (2)

An excess insurer agrees to pay for damages in excess of $250,000 suffered by an insured where the distribution of losses is logarithmic, the mean loss is $10,000, and the median loss is $2,800. What premium would cause the excess insurer to break even:

A reinsurer agrees to pay 80% of the excess insurer's loss that is in turn over $100,000. What premium would cause the reinsurer to break even:

Possible Issues (2)

A mismatch between the dimension of value and the dimension of the distribution dist will gives an invalid distribution:

When one attempts to work with the resulting distribution errors can occur:

Neat Examples (6)

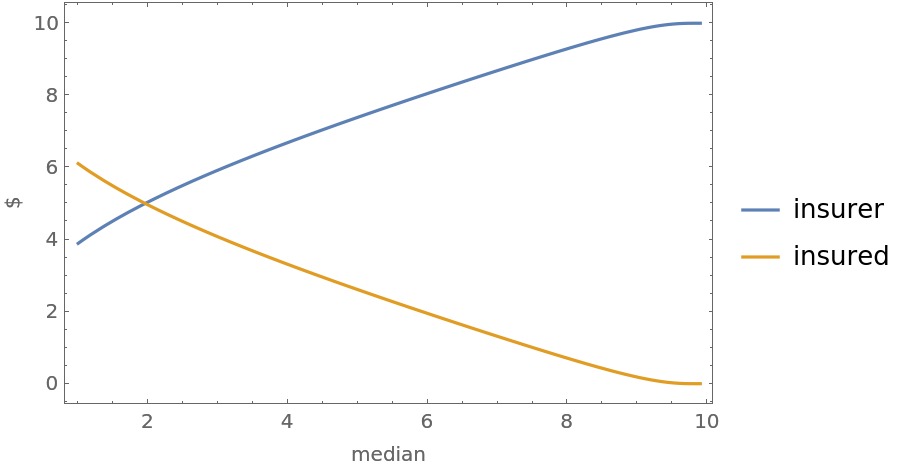

Consider a distribution of judgments in a lawsuit that may be modeled as a log-normal distribution:

Imagine an insurance policy with a limit of 20 and consider the expected positions of the insurer and insured:

Now, consider a second distribution with the same mean but a higher median:

Examine the positions of the insurer and the insured:

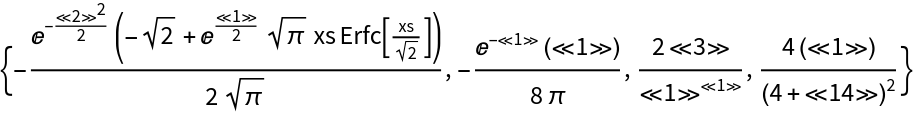

Note the conflict in perspectives. From the perspective of the insurer, the second distribution leaves them in a worse expected position. From the perspective of the insured, the second distribution leaves them in a better position. Plot the difference in case values as the median goes from 1 to 9.9:

Consider how risk aversion alters the analysis. Suppose that when the insured considers two outputs from a distribution, they focus on the worst case:

![ResourceFunction["NonNegativeExcessDistribution"][1/10, ResourceFunction["NonNegativeExcessDistribution"][2/3, UniformDistribution[{0, 1}]]]](https://www.wolframcloud.com/obj/resourcesystem/images/723/7234b8ec-eadf-4a12-8ab3-56ff55ba0dd5/11d58bb661176da6.png)

![NExpectation[d, d \[Distributed] ResourceFunction["NonNegativeExcessDistribution"][250000, ResourceFunction[

ResourceObject[<|"Name" -> "MeanMedianLogNormalDistribution", "ShortName" -> "MeanMedianLogNormalDistribution", "UUID" -> "5af0e61f-890c-4273-8b45-75967c9f256c", "ResourceType" -> "Function", "Version" -> "1.0.0", "Description" -> "Create a lognormal distribution using mean and median as parameters instead of the conventional parameters", "RepositoryLocation" -> URL[

"https://www.wolframcloud.com/obj/resourcesystem/api/1.0"], "SymbolName" -> "FunctionRepository`$99b6a6fd8fd648c4ac9074ef8877525c`MeanMedianLogNormalDistribution", "FunctionLocation" -> CloudObject[

"https://www.wolframcloud.com/obj/da0748d9-6cbb-4132-98fd-fdd3c764b25c"]|>, ResourceSystemBase -> Automatic]][10000, 2800]]]](https://www.wolframcloud.com/obj/resourcesystem/images/723/7234b8ec-eadf-4a12-8ab3-56ff55ba0dd5/0b6f47d282eebd78.png)

![NExpectation[0.8 r, r \[Distributed] ResourceFunction["NonNegativeExcessDistribution"][100000, ResourceFunction["NonNegativeExcessDistribution"][250000, ResourceFunction[

ResourceObject[<|"Name" -> "MeanMedianLogNormalDistribution", "ShortName" -> "MeanMedianLogNormalDistribution", "UUID" -> "5af0e61f-890c-4273-8b45-75967c9f256c", "ResourceType" -> "Function", "Version" -> "1.0.0", "Description" -> "Create a lognormal distribution using mean and median as parameters instead of the conventional parameters", "RepositoryLocation" -> URL[

"https://www.wolframcloud.com/obj/resourcesystem/api/1.0"], "SymbolName" -> "FunctionRepository`$99b6a6fd8fd648c4ac9074ef8877525c`MeanMedianLogNormalDistribution", "FunctionLocation" -> CloudObject[

"https://www.wolframcloud.com/obj/da0748d9-6cbb-4132-98fd-fdd3c764b25c"]|>, ResourceSystemBase -> Automatic]][10000, 2800]]]]](https://www.wolframcloud.com/obj/resourcesystem/images/723/7234b8ec-eadf-4a12-8ab3-56ff55ba0dd5/22f049ca8b700f45.png)

![Plot[{NExpectation[insurer, insurer \[Distributed] CensoredDistribution[{0, 20}, ResourceFunction[

ResourceObject[<|"Name" -> "MeanMedianLogNormalDistribution", "ShortName" -> "MeanMedianLogNormalDistribution", "UUID" -> "5af0e61f-890c-4273-8b45-75967c9f256c", "ResourceType" -> "Function", "Version" -> "1.0.0", "Description" -> "Create a lognormal distribution using mean and median as parameters instead of the conventional parameters", "RepositoryLocation" -> URL[

"https://www.wolframcloud.com/obj/resourcesystem/api/1.0"], "SymbolName" -> "FunctionRepository`$99b6a6fd8fd648c4ac9074ef8877525c`MeanMedianLogNormalDistribution", "FunctionLocation" -> CloudObject[

"https://www.wolframcloud.com/obj/da0748d9-6cbb-4132-98fd-fdd3c764b25c"]|>, ResourceSystemBase -> Automatic]][10, median]]], NExpectation[insured, insured \[Distributed] ResourceFunction["NonNegativeExcessDistribution"][20, ResourceFunction[

ResourceObject[<|"Name" -> "MeanMedianLogNormalDistribution", "ShortName" -> "MeanMedianLogNormalDistribution", "UUID" -> "5af0e61f-890c-4273-8b45-75967c9f256c", "ResourceType" -> "Function", "Version" -> "1.0.0", "Description" -> "Create a lognormal distribution using mean and median as parameters instead of the conventional parameters", "RepositoryLocation" -> URL[

"https://www.wolframcloud.com/obj/resourcesystem/api/1.0"], "SymbolName" -> "FunctionRepository`$99b6a6fd8fd648c4ac9074ef8877525c`MeanMedianLogNormalDistribution", "FunctionLocation" -> CloudObject[

"https://www.wolframcloud.com/obj/da0748d9-6cbb-4132-98fd-fdd3c764b25c"]|>, ResourceSystemBase -> Automatic]][10, median]]]}, {median, 1, 9.9}, Sequence[

PlotLegends -> {"insurer", "insured"}, Frame -> True, FrameLabel -> {"median", "$"}]]](https://www.wolframcloud.com/obj/resourcesystem/images/723/7234b8ec-eadf-4a12-8ab3-56ff55ba0dd5/1dcd0ae4d16cb59c.png)

![{Mean[CensoredDistribution[{0, 20}, j]], Mean@Map[Max, RandomVariate[

ResourceFunction["NonNegativeExcessDistribution"][20, j], {1000, 2}]]} // N](https://www.wolframcloud.com/obj/resourcesystem/images/723/7234b8ec-eadf-4a12-8ab3-56ff55ba0dd5/1d9a38d95b429307.png)

![{Mean[CensoredDistribution[{0, 20}, j2]], Mean@Map[Max, RandomVariate[

ResourceFunction["NonNegativeExcessDistribution"][20, j2], {1000,

2}]]} // N](https://www.wolframcloud.com/obj/resourcesystem/images/723/7234b8ec-eadf-4a12-8ab3-56ff55ba0dd5/5332d9b6351c4a3a.png)